Village Capital Finance P/L (VCAP) embarked on a bold mission to uplift…

Zimbabwe microfinace fund

About Us

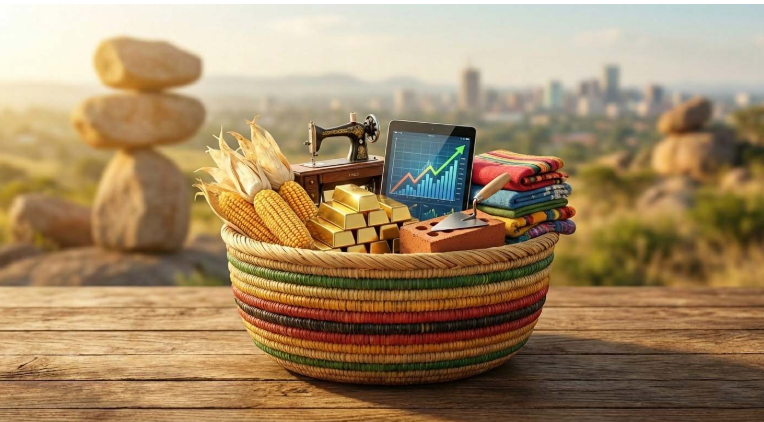

The Zimbabwe Microfinance Fund (Private) Limited, (ZMF), is a wholly owned subsidiary of the Zimbabwe Microfinance Wholesale Facility Trust (ZMWFT). The institution was formed in 2011 to operate as a financial apex organisation providing on-lending capital to financial service providers (FSPs) that include MFIs, SACCOs, Agricultural Value Chain Actors (AgVCA) and Banks downscaling to serve the bottom of the pyramid entrepreneurs. The birth of the Fund followed the collapse of the local currency and the adoption of the multi currencies in 2009. Most FSPs lost their assets in that process and the need for funding to resuscitate the sector became acute. The initial seed capital for ZMF was provided by DFID, HIVOS, Danida and GIZ.